Average salary in Israel

Israel is a highly developed country, particularly in the fields of industry and medicine. This state is known for its high standard of living. The country is on the same level with prosperous European nations in terms of salaries. Therefore, many people would like to obtain Israeli citizenship, having Jewish roots. Let’s find out what the average salary is in Israel. According to the OECD, Israel ranks second place among developed countries considering per capita income growth. Let’s explore other characteristics of earnings in Israel.

Minimum salary in israel

Over the last decade, there has been an increase in the minimum salary in Israel. Currently, it stands at 6,247.67 shekels per month or $1,700. Workers can earn $68 or 250 shekels per day. The hourly minimum wage in Israel is $9.29 or 34.32 shekels. Employees who are 18 years and older, as well as those working full-time in an organization, are eligible for this minimum wage.

an Israeli citizenship specialist

Salaries in Israel

Israel ranks among the highest countries in the world showing a great level in standard of living. With a developed economy, innovative industries, and a highly productive population, Israeli salaries generally exceed those in many other countries. The government offers comprehensive social security programs. Additionally, Israel boasts top-tier education and healthcare systems. However, the cost of living is notably high, especially in big cities, and there are distinct economic and social disparities.

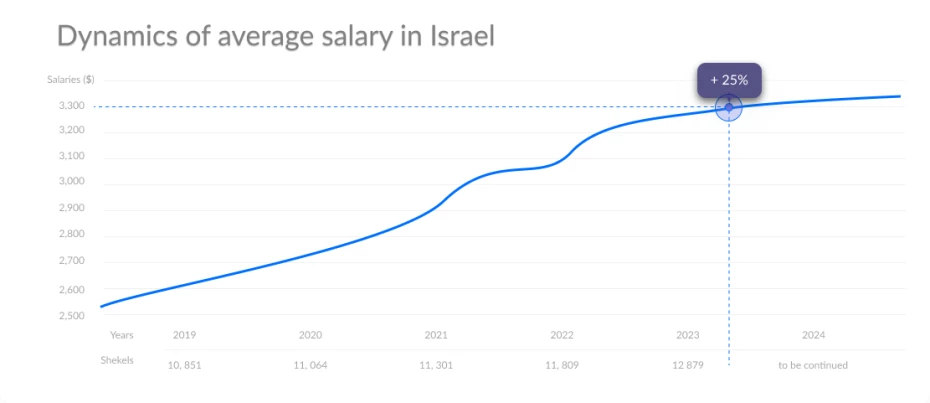

Wage levels in Israel depend on factors such as region, profession, qualification level, and experience. As of 2025, the average monthly salary ranges from 14,000 to 14,800 shekels ($3,800 to $4,000 USD). Salaries can be significantly higher in certain industries and larger cities, especially in well-paying fields like engineering, high tech, finance, medicine and law.

Average Salary by Profession in Israel

In Israel, salaries are determined by specific professions and whether one works in the private or public sector. The table below shows the earnings for various professionals and specialists.

| Profession | Income in Shekels | Salary in USD |

|---|---|---|

| Programmers | 33,697 | $9,400 |

| Drivers | 10,574 | $2,950 |

| Teachers | 8,730 | $2,430 |

| Welders, Electricians | 16,503 | $4,600 |

| Construction Specialists | 13,756 | $3,840 |

| Highly Qualified Medical Professionals | 20,250 | $5,650 |

| Lower Qualified Medical Staff | 10,199 | $2,850 |

| Cooks | 10,574 | $2,950 |

| Engineers | 26,113 | $7,300 |

| Firefighters | 17,000 | $4,750 |

| Police Officers | 17,000 | $4,750 |

| Salespeople | 10,574 | $2,950 |

The highest salaries in Israel are in the fields of Information Technology and Telecommunications. According to OECD reports, there is a shortage of specialists in healthcare.

Worker Salaries in Israel

The construction industry is thriving in Israel, with numerous new projects emerging every year. Workers in skilled trades are paid quite well due to the challenges of building in a hot climate.

There are many opportunities for welders who have specialized knowledge and the required qualifications. Specialists skilled in CNC machine operation also command high salaries.

Average Income by City

Salaries in Israel vary significantly depending on the location and the availability of jobs for foreigners. There are many opportunities in Tel Aviv, the country’s scientific, technological, and financial hub. In this city, one can find jobs paying $2,800 to $4,000 even in professions that do not require special qualifications. Other cities with high income levels include Jerusalem, Haifa, and Ashdod.

| City | Income in Shekels | Income in Dollars |

|---|---|---|

| Jerusalem | 19,500 | $5,450 |

| Tel Aviv | 17,166 | $4,800 |

| Haifa | 19,500 | $5,450 |

| Petah Tikva | 16,000 | $4,470 |

| Ashdod | 15,300 | $4,280 |

| Holon | 14,200 | $3,970 |

| Netanya | 20,250 | $5,650 |

| Ashkelon | 13,000 | $3,630 |

| Nazareth | 12,000 | $3,350 |

| Herzliya | 18,000 | $5,020 |

Income Prospects Without Language Proficiency

Other alternative income avenues without language proficiency include:

- Remote Work: With the rise of remote work and technology, there are various opportunities for online projects or freelance work where language may be less important or not required at all.

- International Companies: Some large multinational organizations with branches or offices in Israel may offer roles in English, as they often communicate with overseas branches.

- Tourism Industry: As a popular tourist destination, Israel offers job opportunities in servicing historical sites, guiding English-speaking tourists, or working as translators.

- Volunteering: Some organizations or communities may offer volunteer work, which can provide accommodation and meals or even be paid.

- Tutoring: If you have knowledge and experience in a certain field, you can offer private lessons in English or conduct online courses.

It’s important to note that learning the local language significantly broadens job opportunities and potential for higher income. If you consider Israel as a long-term residence, learning the language will provide more flexibility and access to more professional opportunities.

Taxes

Income in Israel is subject to medical and social insurance taxes, income tax, and pension fund contributions. A progressive income tax rate is applied. Citizens can expect certain social benefits, while non-citizens are not eligible for tax benefits.

Personal Income Tax (PIT)

Employers are responsible for withholding taxes. Deductions from income are mandatory for all employed individuals, including foreign specialists. The more an employee earns, the higher their tax rate.

Employers are responsible for withholding taxes. Deductions from income are mandatory for all employed individuals, including foreign specialists. The more an employee earns, the higher their tax rate.

| Annual Income (in Shekels) | Tax Rate (%) |

|---|---|

| Up to 83,640 | 10 |

| 83,641 – 120,360 | 14 |

| 120,361 – 193,800 | 20 |

| 193,801 – 269,280 | 31 |

| 269,281 – 560,040 | 35 |

| 560,041 – 721,320 | 47 |

| Above 721,320 | 50 |

Pension Contributions

All working citizens contribute to the pension fund, approximately 6% of their income, matched by their employer. Israel also has a severance fund, to which employers contribute. Pension calculations include both an old-age benefit and a saving system. The old-age benefit is paid to all citizens upon reaching retirement age, while the cumulative part is based on the total number of years worked in the country. If a person has worked more than 10 years and paid taxes, they are entitled to both a pension and a benefit. If the ownership is less than 10 years but taxes were paid, only the benefit is due. The pension system also includes a lump sum payment at retirement, based on the average earned salary multiplied by years worked.

Bituach Leumi Contributions

In Israel, citizens must also contribute to Bituach Leumi, the National Insurance Institute, and to the healthcare fund. Even non-working individuals must contribute, with a minimum threshold of 209 shekels.

Medical insurance payments are calculated as follows:

- From a part of the salary not exceeding 60% of the average wage – 3.1%;

- From income exceeding 60% of the salary – 5%.

Work Week in Israel

It’s important to understand the structure of the work week. Firstly, the work week starts on Sunday. The work week can be either 5 or 6 days, depending on the agreement and contract terms. If the work week is five days, the workday is 8.4 hours, totaling about 42 hours per week. Unions are pushing to reduce the work week to 40 hours.

Despite the high cost of living, Israel is known for its growing economy and favorable investment conditions. People are drawn to Israel for several reasons: its friendly population and society, high medical standards, various social services, career opportunities, and excellent climate conditions.

Conclusion

The standard of living in Israel ranks among the highest in the world, evidenced by high salaries, a developed economy, and extensive social guarantees provided by the government. Consequently, the cost of living is also high, especially in major cities, meaning expenses for housing, food and services can be substantial.

Salaries in Israel vary based on the field of work, with some professions like engineering, finance, and medicine offering higher incomes. Israel’s tax system includes income taxes, medical and social insurance, as well as pension fund contributions. Citizens can also expect certain social benefits.

The workweek in Israel can be 5 or 6 days, with the weekend typically falling on Saturday due to cultural and religious practices. Despite the high cost of living, Israel remains an attractive destination for many, thanks to its friendly society, high level of medical care and favorable climate conditions.

an Israeli citizenship specialist

I want to do job in Israel.

Hello! Unfortunately, WRAI services does not include assistance in finding a job

i need job

Hello! Unfortunately, WRAI services does not include assistance in finding a job