Benefits for repatriates

Repatriation to Israel — the process of returning “scattered” Jews to their homeland—is associated with many peculiarities. The issue of benefits is of particular concern to future repatriates, because it is quite difficult to understand this system without professional help. The state provides so many preferential benefits that the layman is easily confused in their diversity.

The Ministry of Aliyah and Absorption—its role in the life of repatriates

Additional benefits for new repatriates are provided by the Ministry of Aliyah and Integration. This is a separate Israeli government department that works in the field of immigration. Since the first day of work in 1948, the body has been monitoring repatriates and integrating them into all spheres of life.

an Israeli citizenship specialist

The ministry was created during the formation of the Israeli state and lasted 3 years. But it was successfully restored in 1968, when the immigration wave after the Six Day War reached its peak. This event became the starting point for the awakening of the national identity of the Jewish diaspora. Those wishing to return to the Promised Land arrived literally from everywhere: from South and North America (including the USA), Europe, and South Africa. At that time, at the initiative of the Ministry, special centers were built, and Hebrew training was organized for immigrants.

Today, the goal of this department is to maximize the potential of repatriates and their successful absorption. The Ministry provides all the necessary tools to settle down in a new place of residence as soon as possible. This applies to all aspects of life: real estate, employment, education, taxation and so on.

Types of benefits for repatriates

The full list of subsidies includes material, educational and tax subsidies: “absorption basket”, subsistence allowances, ulpan, benefits for the purchase and rental of housing, reduced tax rates and much more. Let’s consider in more detail.

“Basket of Absorption”

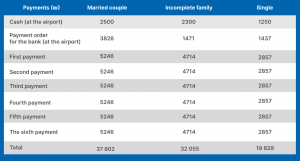

In Israel, it is called “sal kita” and consists in material assistance to new repatriates for the first six months of their stay in the country. The subsidy was created to speed up the process of integration of newly minted citizens into society. An “absorption basket” is issued to all new repatriates universally.

The following categories of citizens have the right to receive sal whales:

- Returnees who first arrived in the Promised Land. In this case, they need to open a bank account and submit their data to the Ministry;

- Repatriates who, at the time of registration of citizenship, live in the country for no longer than a year;

- Persons under the age of 18 who have undergone the repatriation procedure (ktinim khozrim).

Therefore, if the repatriate has not issued an absorption basket within 12 months from the date of arrival in the country, then he loses the right to it. The same is true if a person left the Promised Land for a period of time. In this case, payments can be restored within a year upon return.

Payments from the “absorption basket” do not need to be returned over time. The amount of financial assistance depends on several factors:

- whether the repatriate is retired;

- whether he arrived in Israel alone or with other family members;

- whether he has children (their age and number also matters).

an Israeli citizenship specialist

If we consider the basket on the example of a citizen who repatriated to the Israel alone and did not reach retirement age, the payment conditions will be as follows. The benefit has two parts. The first is paid immediately upon arrival: one share in cash (1250 shekels) and the other (1430 shekels) to an open account. The remaining money is divided into 6 payments, which will be issued within six months (2622 shekels each). Furthermore, the repatriate receives benefits for renting real estate.

Subsidized living wage

If, after the expiration of the payment period from the absorption basket, its owner is still unemployed and has been in Israel for less than a year, the Ministry undertakes to provide a living wage. It is paid from the 7th to the 12th month of the repatriate’s stay in the country. The number of benefits here is also individual, because it is determined by the following conditions:

- the number of family members, including children;

- the presence of third-party sources of income.

Another factor is considered a good reason for applying for this subsidy—the presence of official work, which is paid with an amount less than the subsistence level. Then the state makes an additional payment of the missing difference.

The subsidy is not paid immediately upon the returnee’s arrival, like a “basket”. To receive these payments, you need to apply separately to the Ministry of Aliyah and Integration. To achieve this, you have to meet with the curator of the Ministry and attach several documents to the application. Another prerequisite is the presence of registration in the employment service.

Subsidies for vulnerable groups of the population

This category includes people who for some reason do not have employment opportunities, namely:

- returnees with disabilities;

- single mothers with preschool children;

- pregnant women;

- persons of pre-retirement age;

- pensioners.

This is a kind of analogue of benefits to support the living wage, but for disabled citizens. Accordingly, payments are also made after the expiration of the “absorption basket” before the end of the period of 12 months of residence in Israel.

Free Hebrew course

The locals call it “ulpan”. It includes not only teaching Hebrew, but also immersion in national culture and traditions. All this contributes to the speedy socio-economic integration of new repatriates.

The program of the Ministry provides for training up to the second level or, as it is also called, bet. This is for persons who do not have any language knowledge of Hebrew. If the repatriate has the necessary base, he is given a choice of several training programs. All of them differ in the level of deepening in the study of the language.

Ulpan lasts about 5 months, subject to 25 hours of practice per week. Jews who have immigrated to Israel are entitled to a free course for 10 years from the date of arrival. Optionally, you can choose daytime and evening classes—fairly convenient for working repatriates.

For holders of higher education there are additional privileges: the study of Hebrew with a professional bias, depending on the specialization.

Help for schoolchildren and students

Subsidies are paid to students in institutions recognized by the Ministry of Aliyah and Integration. Upon arrival in Israel after repatriation, an application must be submitted within three years. There, applicants are instructed about admission to specific educational institutions. Namely, about the necessary documents, the requirements of the university and the financial assistance that is due.

When a student of a new immigrant is transferred to an Israeli school, he receives various benefits and discounts for the purchase of educational materials, visits to excursions and other events. There are also optional Hebrew courses for schoolchildren, which are needed to compensate for the language gap due to repatriation.

Tax Benefits

The issue of taxes for immigrants is particularly acute, because the taxation system in Israel is perplexing. Let’s take it in order. Tax incentives vary, depending on the stage and type of expenditure. For example, there are customs privileges for the import of equipment, furniture items, and machines. Furthermore, the Promised Land provides preferential taxation when buying a car. A repatriated person may pay half of the due number of taxes. This offer is valid for 36 months from the date of arrival in the country.

Income tax is a separate issue. It depends on the amount of income. That is, the more a citizen receives, the higher the taxation. The minimum is 10% and the maximum is 50%. And for new immigrants there are concessions. A person is partially exempt from paying this tax for the first 3.5 years of residence in the status of a repatriate.

Benefits for the purchase and rental of housing

You also have certain benefits for real estate transactions. The State of Israel covers part of the rental costs for the first 3 years after repatriation. There are also benefits for the purchase of housing at a reduced interest rate.

Employment Benefits

New immigrants can be assisted in finding a job. The state also provides an opportunity for professional aliyah through specially organized repatriation programs. Including obtaining a license. It is necessary for the professional activities of doctors, lawyers, psychologists and so on. There is a separate list of professions that require verification (theoretical and practical). For example, for workers in the field of catering, transport, science. Repatriates get the opportunity to attend special courses to prepare for the professional exam.

Free health insurance

Upon arrival in Israel, each repatriate must take out medical insurance at the Health Insurance Fund. Access to Israeli medicine is provided by Bituach Leumi, the Israeli National Insurance Institute. Thanks to legislation, it exempts repatriates from paying tax for insurance during the integration period. This release lasts six months from the date of repatriation.

Help and advice

We help you get:

- benefits for the transportation of personal belongings, furniture, and cars;

- free education in ulpans for the full study of Hebrew;

- reduced tax on real estate transactions.

In the first years of repatriation, we will help:

- exempt from social tax for new citizens of Israel;

- get health insurance;

- reduce the amount of the arnon council tax;

- get a discount when buying a vehicle;

- apply for financial assistance for housing rent.

Seeking qualified support from professionals will save you from many problems. WRAI guarantees success as 99% of clients receive an Israeli passport. Our team knows about all the nuances of the procedures and will provide full information support. Two days in Israel—and you will acquire the citizenship along with all the benefits!

FAQ

In addition, new immigrants are entitled to significant tax and customs benefits and free Hebrew courses.

In addition, new immigrants are entitled to significant tax and customs benefits and free Hebrew courses.

an Israeli citizenship specialist